What is Swing Trading And How Can It Help Traders Improve Their Strategies?

Cryptocurrency traders are trying to improve their trading strategies through different techniques. One of the most popular trading styles that these individuals could use is known as Swing Trading. In this article, we will explain what Swing Trading is and how it could help users improve their trading activities and results over time.

What is Swing Trading And How Can It Help Traders Improve Their Strategies?

Cryptocurrency traders are trying to improve their trading strategies through different techniques. One of the most popular trading styles that these individuals could use is known as Swing Trading. In this article, we will explain what Swing Trading is and how it could help users improve their trading activities and results over time.

What is Swing Trading?

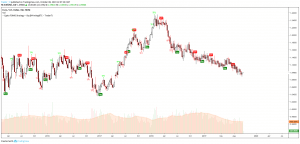

Swing Trading is one of the most popular ways for traders to buy and sell cryptocurrencies, stocks, options and other assets. In general, Swing Trading positions tend to be open between two days and two weeks, allowing the price of a specific asset to evolve and mature before making a trading decision. This is specifically useful for the cryptocurrency market because the volatility in the space tends to make it a much more suitable strategy than for traders operating in traditional markets. With this strategy, it is possible for traders to follow overall trends in the market and exploit price movements within these specific trends. This is why it is certainly important for traders to identify the general course in which an asset is moving at that time. Technical analysis would be a very helpful tool for individuals that want to perform Swing Trading strategies while trading in the cryptocurrency market. These tools would certainly let them enter the market at certain levels and close their positions in the correct moment. Some users prefer to operate during bull markets while others tend to Swing Trade with cryptocurrencies in a bear trend. In addition to it, fundamental analysis behind specific cryptocurrencies could help traders understand specific movements. For example, shocks in supply or demand, sudden spikes or drops in hash rate or network activity and other things would also play an important role at the time of entering or leaving the market. To have better results, it is very important for traders to combine fundamental and technical analysis. Thus, Swing Trading requires traders to have basic knowledge of technical analysis and fundamental analysis. Charts and fundamentals work together, combined with the trader’s ability to take correct decisions leaving emotions aside.

Day Trading vs Swing Trading

In the cryptocurrency market, there are several traders that perform day trading activities. During the bull trend Bitcoin (BTC) and other cryptocurrencies experienced in 2017, new users entered the market and started buying and selling cryptocurrencies. Those newcomers that had previous experience in trading activities were able to profit from the large swings Bitcoin and other crypto-assets experienced throughout each day. The main difference between Day Trading and Swing Trading is based on the timeframe in which investors enter and leave the market. Day Trading activities, as the name suggests, are performed by traders that buy and sell an asset in a period of under 24 hours. Meanwhile, Swing Trading activities are performed by investors in a longer period (2 days to 2 weeks). Day traders try entering the market at a very specific moment in which an asset changes its direction. In general, the best moment for a day trader to enter the market is when an asset experiences an increase in volume and a sudden spike or drop. The goal is to wait a short time and sell the asset with a nice profit. If the asset suddenly surges, the trader may wait until there is a reversal during the same day. If the asset drops, the trader would try implementing the same strategy and leave the market as soon as the asset finds a bottom.

As we previously wrote at AltSignals, the primary reason why it is possible to perform day trading activities is due to the inherent volatility that Bitcoin and other cryptocurrencies have. There are pros and cons for day traders and swing traders. Day traders may prefer to go for a safe and small return rather than taking the risk to wait for a longer time and earn a higher return. Depending on the volatility of the asset, swing traders may be able to earn a larger profit on their positions. While a day trader would close its position within the day, swing traders would wait for the asset to go higher (or lower) before leaving the market. This also increases the risk for the swing trader. He is subject to possible trend changes in the asset he is trading. This is something that day traders are less exposed to.

Swing Trading Conclusion

Swing Trading is a very attractive trading style that allows individuals to trade an asset in a time period of 2 days to 2 weeks. These users do not wait for a trend to change to close their positions. They simply trade within a specific trend that could be bullish or bearish. Although Swing Trading can be mistaken with Day Trading, there are some differences in the strategies implemented by each of these two trading styles.

We are a large scale cryptocurrency community

providing you with access to some of the most exclusive, game changing cryptocurrency signals, newsletters, magazines, trading indicators, tools and more.