What is AAVE? Complete Guide

AAVE is one of the most promising projects in the decentralized finance (DeFi) market. It has been expanding in recent months and it is now offering a wide range of solutions to users from all over the world.

AAVE is one of the most promising projects in the decentralized finance (DeFi) market. It has been expanding in recent months and it is now offering a wide range of solutions to users from all over the world.

In this AAVE complete guide, we will go through the most important things of this protocol. Moreover, you will learn how it works, the services it is offering and more. Are you ready to go through this guide with us?

What is AAVE?

AAVE is one of the most advanced decentralized finance protocols in the market. The AAVE ecosystem runs on top of the Ethereum (ETH) network and it allows users to lend, borrow and earn interest on different cryptocurrencies. The most important thing about this project is that, as it is decentralized, there is no middleman working as an intermediary.

AAVE works as a system of smart contracts that allows it to offer financial solutions to users that want to have access to them. There is no need for users to go through traditional centralized platforms but everything can be done using a decentralized platform.

Users can lend and borrow a wide range of digital assets. Some of these assets include Ethereum (ETH), Basic Attention Token (BAT) or Decentraland (MANA).

Lending and Borrowing

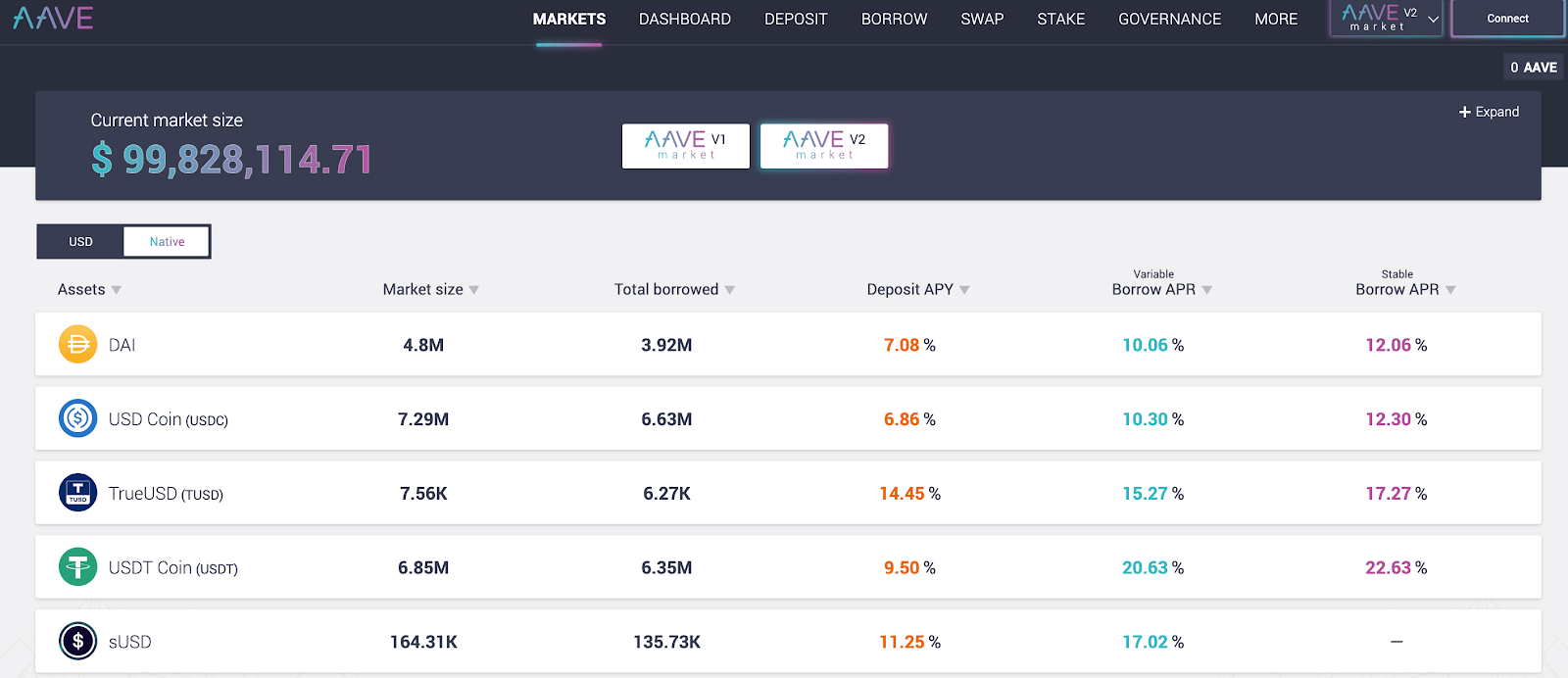

By lending your funds to other users, you can earn up to 11.25% APY. That means that the yield is very high compared to traditional finance solutions. You would be able to provide users with the possibility to borrow funds and they will pay an interest rate to you.

The APY tends to change over the year. This depends on the market conditions. The larger the demand for an asset and the lower its supply on the AAVE market, the higher the interest rate. You can change between different digital assets and get the highest interest rates in the market.

This can be a great solution for challenging low-interest rates in the traditional economy. Nowadays, interest rates are close to 0%. That means that investors cannot save, but they are pushed to search for riskier options to make some profits and not being eaten by inflation rates.

Borrowers can easily get ETH and use DAI or another cryptocurrency as collateral for the funds borrowed. This allows users to gain exposure to digital assets without necessarily owning them. Once the owner of the funds decides to give back the ETH borrowed, he will get his DAI (or other cryptos) back.

The interesting thing is that everything is performed using smart contracts without the user even knowing how the whole system works. This can be considered one of the best ways of using blockchain technology.

Additionally, AAVE is also offering users with additional features, including instant loans and many other things. Everything leveraging blockchain technology and its different use cases.

What is Decentralized Finance?

The Decentralized Finance market, as the name suggests, makes reference to financial solutions that are offered to users in a decentralized way. There are several services currently offering Decentralized Finance solutions and AAVE is currently one of the most popular ones. Most of them are usually running on top of Ethereum due to how efficient this network is to handle these platforms.

These solutions have been expanding in recent years and they are increasing the number of solutions users can enjoy in the cryptocurrency market. In the past, it was only possible to send and receive transactions using cryptocurrencies, nowadays, it is possible to do this and more.

With the DeFi market, users can now lend, borrow, provide liquidity to mining pools and earn rewards on their digital currencies. This is why it became so important for users to have an alternative to traditional finance bu in the cryptocurrency market.

Moreover, there are several exchanges that have also decided to join this DeFi market expansion and started offering similar solutions but with the easy-to-use interface of exchanges. As the market continues growing and attracting new users, there will be new functionalities and services offered by these platforms.

Some other projects in the market include MakerDAO, Curve Finance and Yearn.Finance. All of them have been growing in recent months and they have been attracting a large number of users. It has never been so easy to get access to credit by using digital assets. Moreover, you can also enjoy high-interest rates in order to escape from low-interest rates traditional finance solutions such as bonds or traditional bank deposits.

We are a large scale cryptocurrency community

providing you with access to some of the most exclusive, game changing cryptocurrency signals, newsletters, magazines, trading indicators, tools and more.