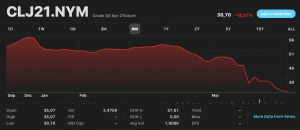

Oil Price Reaches $29 While EM Currencies Experience Massive Sell-off

Oil prices have fallen below $29 in a day in which stock markets are operating negatively after the continuous expansion of the Coronavirus. Cryptocurrencies have also been affected and they are being traded close to their lowest level in several months.

Oil prices have fallen below $29 in a day in which stock markets are operating negatively after the continuous expansion of the Coronavirus. Cryptocurrencies have also been affected and they are being traded close to their lowest level in several months. The main question is whether there will be an end in the near term for the current financial crisis. Emerging markets have also been affected by the current crisis. Currencies all over the world are falling against the USD as demand for the North American currency grows. The British Pound reached its lowest point in the last 35 years.

Oil and Markets Fall – EM Currencies Crash

The U.S. West Texas Intermediate crude has fallen almost 10% to under $29 for a short period of time. The same happened to the WTI who was also close to $28. According to experts, this is related to a massive drop in demand for oil. Of course, this is closely related to the Coronavirus expansion and how it is affecting financial markets and the real economy.

European markets have fallen again on a red day for most of the stocks. The FTSEMIB in Milan, the epicentre of the Coronavirus outbreak in Europe registered losses of 1.27%. In Spain, the IBEX lost 3.73% and in Germany, the GDAX Index operated almost 5% down. Meanwhile, in the United States, the Dow Jones is currently falling by 7.31% followed by the NASDAQ with 5.41% losses.

EM Currencies and British Pound Plunge To New Lows in Years

Emerging markets are also being affected by the current situation in the markets. Indeed, as countries plan new fiscal stimulus packages, emerging currencies are losing part of their value. Investors are moving their funds from EM to cash selling their positions in local currency. That would allow them to be protected against the current financial crisis that is affecting everyone around the world. The Brazilian real (BRL) reached a new all-time low against the dollar when the U.S. currency was purchased for 5.13 BRL. This represents an increase of almost 30% compared to less than six months ago. This could not be over. It will be important to see how the next few days are for the entire global economy and for international and local investors in Brazil. At the same time, the Russian ruble (RUB) surpassed the 80 RUB barrier per USD. This represents an increase of more than 30% since early January. Something similar happened to the Mexican peso (MXN). Each USD can now be acquired for 23.89 MXN, almost 25% more than last month. In Europe, the Polish Zloty (PLN) and the Hungarian Forint (HUF) are also losing their value. With new measures announced by the Polish government to mitigate the effect of the current crisis, the Polish Zloty reached its lowest level since 2016 at 4.20 PLN per dollar. In Hungary, the HUF reached new all-time highs as investors prefer to get USD rather than local currency. The British pound (GBP) is also being affected and harmed by the financial crisis. Indeed, the Pound fell to the lowest point in 35 years. Each USD can now be acquired for £0.86 compared to £0.74 a few months ago. This shows that the world is now demanding USD rather than local currencies. This is not only affecting small and emerging countries but also large and strong economies such as the United Kingdom. In the coming weeks, the UK government may lockdown London in a bid to stop the spread of the Coronavirus.

Trading the Bear Market

AltSignals provides great solutions for traders that want to be active in the FX market during the current volatile times. The team behind AltSignals is working on a daily basis to provide the best solutions for traders. In the last trading period (February), traders were able to get a winning rate of 68% with AltSignals. That means that of all the signals there were 17 winning ones and only 8 losses. Although AltSignals focuses on the cryptocurrency market, they are also offering trading solutions for experts in the FX markets. The aforementioned changes in the price of the assets are going to be certainly harmful to traders if they do not know when to properly enter or exit the market. AltSignals provides crypto trading signals through Telegram that help newcomers and experienced traders to understand better how to trade both FX and virtual currencies.

We are a large scale cryptocurrency community

providing you with access to some of the most exclusive, game changing cryptocurrency signals, newsletters, magazines, trading indicators, tools and more.