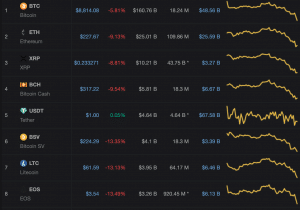

Bitcoin (BTC) and cryptocurrencies are currently experiencing a massive sell-off. Indeed, Bitcoin is falling by over 6.6% while other digital assets are losing even more than 14%. Ethereum (ETH) is now traded 11% down, followed by XRP (-10.10%), Bitcoin Cash (BCH) (-11.53%), Bitcoin SV (BSV) (-15.65) and Litecoin (LTC) (-14.42%). This is the largest price decrease for virtual currencies this year, showing that the market could be taking a break from the upward trend that it started a few weeks ago. At the same time, it is worth mentioning that Bitcoin has ended its correlation with gold, the world’s recognized safe-haven asset. During the last few weeks, Bitcoin’s correlation with gold became apparent and attracted the attention of users and traders. https://twitter.com/caprioleio/status/1232255506691055627?s=20

Is Bitcoin Correlated to Macro Assets?

Cryptocurrency enthusiasts and traders were usually taking Bitcoin as a safe haven asset. When Bitcoin started to move higher earlier this year and in the first days of February, they considered it was due to the fact that Bitcoin could work as an asset to protect investors from the current coronavirus. Nonetheless, this showed wrong. As Coronavirus expands and moves forward in Europe and other Asian countries, Bitcoin and digital assets experienced a massive sell-off. This is part of a general negative sentiment that has affected global markets around the world. While gold was surging and continues to move higher, Bitcoin now seems to be behaving as Bitcoin usually does, without being correlated to any asset or situation in the market. The truth is Bitcoin needed to experience a correction after the bull market that experienced throughout 2020.

Bitcoin Volatility

Both Bitcoin and the crypto market tend to be very volatile. Indeed they have always experienced massive price increases or sudden drops. Traders should always take into account that this market is very volatile and it can affect the way in which they plan their investment strategies. Usually, analysts suggest allocating between 1% and 5% of your portfolio in Bitcoin or digital assets. Virtual currencies have the possibility to move higher in the future. One of the best ways to trade in this market is by following AltSignals crypto trading signals. AltSignals is also providing technical and fundamental analysis. This would not only allow you to be more profitable while trading but it would also be very helpful for newcomers to learn how to analyze trends and digital assets.If AltSignals releases a signal for a crypto trading pair on BitMex, then, it will be great for investors that will check whether this is a good time to invest, enter the market or leave it.

Bitcoin Halving Event

Bitcoin is going to be experiencing a halving event in the coming months. Specifically, in May 2020, Bitcoin rewards for miners are going to fall from 12.5 BTC per block to 6.25 BTC per block. This is due to the fact that every 210,000 blocks mined, the rewards are cut by 50%. If that happens and demand for the virtual currency surges, it might be possible for the most popular digital currency in the world to move towards new highs. Bitcoin’s highest price was registered in 2017 when it was traded close to $20,000. Since then, Bitcoin was not able to surpass that price or be traded close to it. At the time of writing this article, each Bitcoin can be purchased for $8,800 and it has a market capitalization of $160.76 billion. Ethereum, the second-largest virtual currency is now being traded close to $227 and it has a price of $25 billion.

Conclusion

Bitcoin and Gold have been traded in tandem in the last few weeks, something that called the attention of crypto and traditional traders. The Coronavirus outbreak pushed many enthusiasts to think virtual currencies, specifically Bitcoin, were going to work as a safe haven asset.Today, two days after the global financial markets crashed, Bitcoin followed them and ended its short-term correlation with gold. Disclaimer:All the information provided by AltSignals and its writers shouldn’t be considered, by any means, investment advice. All the data shown in these articles is for educational purposes and should be taken as such. Always request professional advice before investing and never invest more than what you are able to lose. Remember that the cryptocurrency market is very volatile and that it could be very harmful to your financial life.